Estimating a financial budget for a small business or evaluating the costs involved to set up and run a start-up company is crucial. As a start-up entrepreneur or a small business owner, you may have limited funds and lesser investment options. Hence, there is no doubt that creating a financial budget for your small business can be overwhelming and probably even daunting. However, if you plan appropriately, making a financial budget is not that difficult at all!

So, what exactly is a financial budget?

A financial budget is a plan that is well-defined and valid for a certain period of time. Usually, financial budgets for small businesses are valid for a period of 6-months to one-year. The financial budget also includes estimated volumes of sales, revenues, resources, expenses, assets, liabilities, and cash flows. In simple words, the financial budget explains how the business will make money and spend the acquired money in the same time frame.

Why do small businesses need a financial budget?

A financial budget supports you as a small business owner. It determines if you have enough money to execute the business plans. Setting up a new company can be an ambitious decision. However, being a small business owner you must understand if you have the capacity to fund procedures and expand operations as and when required. The ultimate goal of every business is to generate income, for this reason, small businesses must draft a financial budget.

There are several other reasons why small businesses need a financial budget. But the below stated are the three top reasons that define the need of having a financial budget.

- Having a financial budget creates an outline limit for all the investments, so that start-up firms do not run the risk of making more than estimated investments.

- With a financial budget, small businesses can spend an adequate amount to compete. The idea is not to become too stringent and limit expenditure altogether.

- Financial budgets for small companies also ensure that the business does not fall short to build an emergency backup.

Steps to make a financial budget for small businesses:

Inspect Revenue

Revenue is nothing but money in the business. While making a financial budget, inspecting revenue is the first step and the core of budgeting. Inspecting revenue simply means small businesses must determine sales, production costs, expenditures, and investments. As your revenue inspection progresses, you can determine if your business needs to continue current practices or take corrective measures.

Examine Income

List down and examine all your income sources while creating a financial budget for your small business. Building a small business budget requires you to ascertain your income sources. Examine how much money the business can make on a monthly, quarterly, bi-yearly, and yearly basis. You can also add any additional expected sources of income your business is likely to generate. Ensure to account for all income sources and tally to have a clear picture of your total periodic income.

Analyze Fixed Costs

Distinguishing fixed costs is very simple for small businesses. It fundamentally accounts for all recurring costs generated for the operation of your small business. Fixed costs may reoccur daily, weekly, monthly, or even yearly. It is essential to have a detailed data of the fixed costs involved, so that small businesses can deduct it with the total income and move forward to rightly evaluate the financial budget.

Estimate Inconsistent Expenses

Small businesses may frequently come across inconsistent expenses. For small businesses, inconsistent expenses may be initially insignificant, however, with growth in the business these expenses may intensify. Therefore, maintaining an account or estimating inconsistent expenses in the financial budget from the beginning is important. Also, most of the time these varying expenses are critical for the functioning of the business – such as utility costs, agency costs, etc.

One-Time Expenses

One-time expenses are not as frequent, but possibly pricier. These costs are generally related to assets, infrastructure, permissions or licensing. Calculating one-time expenses in the financial budget can help you ballpark resources required to support these expenses. Being a small business owner, you must ensure that one-time expenses, primarily caused by emergencies must not break the budget! Maintain a reserve to save yourself. Having additional money marked as reserve could help you from not getting caught off guard by one-time expenses.

Evaluate Contingency Fund

Maintaining reserves are not just for one-time expenses, but small businesses need to approximate and evaluate contingency funds. Start-up firms must set aside money to cover any expected or unexpected expenses that may arise in the future. This money is also referred to as contingency funds. Contingency funds assist small businesses during uncertainties. A standard practice followed by most small businesses and start-ups is to maintain 10% as the contingency fund of the total budget.

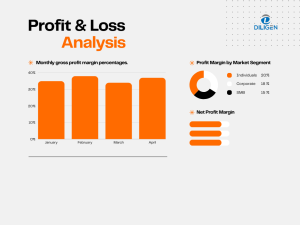

Create P&L Statement

The next step is to create a profit and loss statement after you have gathered all the above-mentioned details. Being a small business owner it can be overwhelming to create a P&L statement. But all you have to do is addition and subtraction to arrive at a cohesive conclusion. Add all the incomes and expenses for designated time-frame and subtract the expenses from the income to get the final amount. If you have a positive number you made a profit, while a negative number indicates a loss. Rather than creating monthly P&L statements, small businesses must follow bi-yearly or yearly P&L reports.

Speak to An Expert

If you are a new start-up entrepreneur you might not have the required practical knowledge and experience to create an accurate financial budget. This is why small businesses should consider speaking to an expert before or while making a financial budget. An expert helps you understand the various factors that influence the financial budget. These include the type of business activity, the region of business, the number of employees you hire, etc. With an expert, you can have a clear budget plan and a comprehensive financial forecast.

To experience it yourself, speak to an expert from Diligen.

At Diligen, we create financial budgets that act as an action plan for your small business. We outline the financial and operational goals and help you track and manage income and expenses efficiently.

For more information, get in touch with Diligen today!